Honor Council Defends Spending

The Student Association Blanket Tax Contingency Committee met with Honor Council on Oct. 27 to discuss the organization’s projected budget for the coming year.

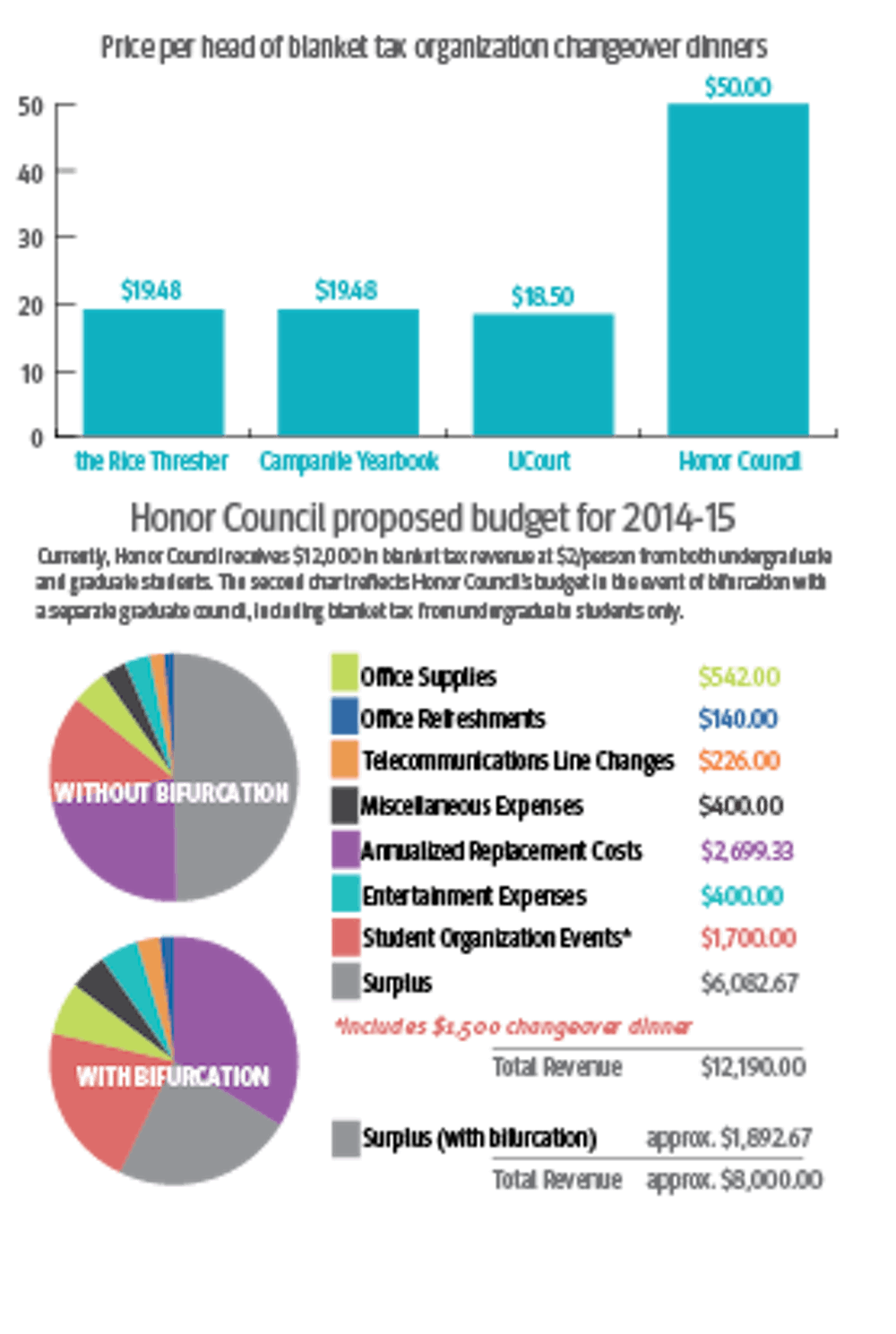

Honor Council’s projected 2014-15 budget, which was submitted two days after the Contingency Committee’s Oct. 20 deadline, allocated $6,107.33 for annual expenditures out of the $12,190 revenue from its current $2.00 blanket tax. This leaves an annual surplus of 50 percent the current proposed budget does not account for.

Missing Documents

Honor Council has not yet submitted its expense reports from the past four years, which were requested by the Contingency Committee two weeks ago. The deadline for these submissions was Oct. 20.

According to University Court Chair Brian Baran, if Honor Council does not comply with the Contingency Committee’s requests, it can be referred to UCourt and held in violation of the SA Constitution.

“An organization that fails to comply with the oversight procedures for student money is not a good steward of student money,” Baran, a Duncan College senior, said.

Bifurcation

An issue Honor Council raised in the meeting was the Faculty Senate’s proposal to bifurcate Honor Council into two separate undergraduate and graduate branches. In a letter to the Contingency Committee, Honor Council Chair Hurst Williamson said bifurcation will lower the total blanket tax amount the organization receives and will make any blanket tax amount lower than $2.00 insufficient for the needs of Honor Council if it goes into effect.

“If graduate students no longer contribute to the Honor Council’s blanket tax income, any blanket tax less than the current $2.00 puts the Honor Council at risk of being unable to fulfill its mission,” Williamson, a Hanszen College senior, wrote.

The possibility of Honor Council’s bifurcation assumes that, with 4,000 undergraduates, the $2.00 blanket tax will result in $8,000 revenue for the organization. This still leaves approximately $2,000 of surplus unaccounted for in the proposed budget.

Replacement Costs

The proposed budget allocates $2,000 for furniture replacement every five years and $6,898 for technology replacement every three years. The three-year replacements include a $1,099 computer, a $549 printer and $5,250 for tablets priced at $350 each.

During the meeting, the committee questioned whether it was necessary for computers and tablets to be replaced every three years.

However, Honor Council advisor Lisa Zollner said the organization has consulted with sources, and concluded that this replacement schedule is appropriate.

“We’ve chatted with people who have been through many, many cycles of replacement and their notion was that replacing a computer any longer than every three years, you’re putting the data at risk of being lost,” Zollner said.

According to the United States Internal Revenue Service property depreciation values, computers are scheduled as five-year property while furniture is seven-year property.

Baran said his organization does not feel the need to replace UCourt computers on a three-year schedule.

“UCourt replaces computers when they stop working,” Baran said.

According to Zollner, it is important that Honor Council replaces its computers and tablets frequently to ensure that important files and transcripts aren’t lost due to old computers crashing.

“I don’t want to wait until [Honor Council is] in a crisis,” Zollner said. “I want to make sure that the Council has clean, well-functioning machines, because if it crashes and inhibits their ability to hear cases, it is a disaster.”

Contingency Committee voting member and Blanket Tax Officer Anastasia Bolshakov said there are more reasonable ways to ensure the safety of files than to purchase new hardware every three years.

“There are more economical ways to ensure that your files are backed up, such as a backup drive, which is what [blanket tax organizations] Thresher and Campanile use, or a Rice-provided server,” Bolshakov, a Duncan College senior, said.

Bolshakov, who is also editor in chief of the Campanile, said her organization does not frequently replace computers, despite the fact that they store hundreds of gigabytes in files and are used for extensive design and editing.

“We wait until [the computers] are on their dying legs,” Bolshakov said.

Changeover Dinner

The committee also raised concerns regarding the projected expense of $1,500 for Honor Council’s changeover dinner, which takes place at a private venue off campus.

According to Williamson, the Honor Council changeover dinner requires privacy due to the sensitive nature of the topics discussed and the officer elections that take place at the time.

“We want to make sure that we are not opening up any cases [or] student’s names, even though we never use student’s names, heaven forbid, slip of the tongue,” Williamson said. “We want to make sure nobody from Rice is potentially around to hear that. It’s an argument for moving it off of campus [and] getting a private room.”

The Committee asked Honor Council to look into other options of private places on campus and lowering the overall cost of the dinner from its current price of $50 per person to $25 per person, which is comparable to the amount other blanket tax organizations spend on their end-of-year dinners.

Last year, Campanile and Thresher spent $779 on a joint dinner catered at Farnsworth Pavilion, which cost $19.48 per person. UCourt spent $18.50 per person for a 17-person dinner that totalled $315.

Surplus

In the meeting, Zollner said while the surplus in the projected annual budget has not been allocated for any specific spending, it might be used in the future to fund educational conferences for members of Honor Council.

“I do know that at some point the Honor Council leadership attended conferences and received training,” Zollner said. “That’s something that we’d like to leave a little space for [in the budget].”

While Williamson’s letter said Honor Council members have attended conferences in previous years, there is no record in previously submitted budgets and expenses of the organization’s surplus being used to fund the expenses for these conferences in the past.

Williamson also wrote in his letter that Honor Council would be willing to return $16,000 of its current rollover budget to the SA if its blanket tax funding remained at $2.00.

Bolshakov said this proposal does not address the issue of how student blanket tax money is being handled.

“It’s a valiant proposition, but what is the SA going to do with that money?” Bolshakov said. “It’s the blanket tax of students that no longer go here.”

More from The Rice Thresher

Rice to support Harvard in lawsuit against research funding freeze

Rice, alongside 17 other research universities, requested a federal judge for permission to file an amicus curiae brief in support of Harvard University’s lawsuit against the Trump administration over more than $2 billion in frozen research grants.

Mayor Whitmire discusses ‘the state of Houston’ between audience protests at Baker Institute

John Whitmire’s remarks on the city’s budget, transportation and infrastructure were interrupted twice by shouts from audience members at a Baker Institute event May 29. At the event, which was open to the public, Whitmire spoke about the current state of Houston alongside former county judge Ed Emmett.

Rice reaffirms support for international students after Trump administration targets Harvard

Rice and the Office of International Students and Scholars said in a May 23 email that they are monitoring the Trump administration’s actions towards Harvard to bar the school from enrolling international students. A federal judge temporarily halted the move less than 24 hours later.

Please note All comments are eligible for publication by The Rice Thresher.